China Iron ore spot price, China Iron ore Daily prices provided by SunSirs, China Commodity Data Group

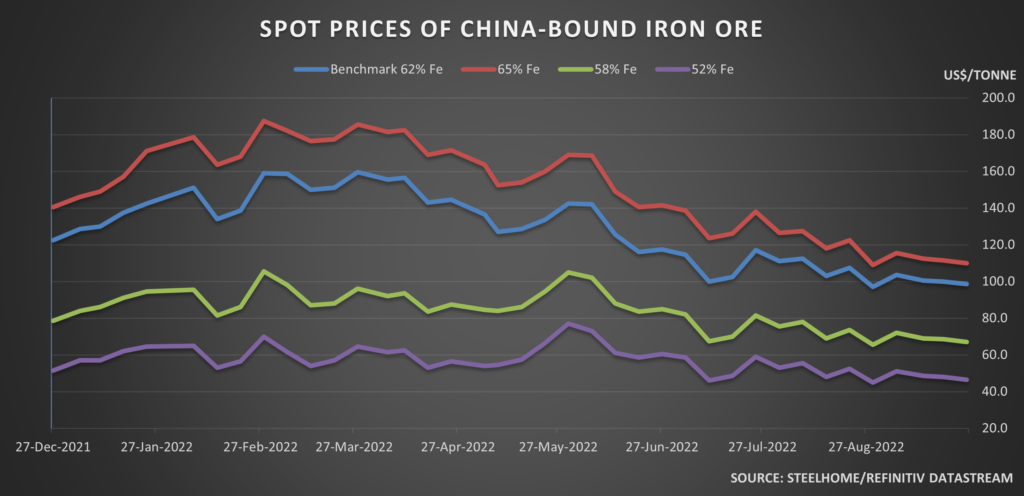

Iron ore prices take a hit on weak demand amid surge in Platts-observed spot activity: 2022 review | S&P Global Commodity Insights

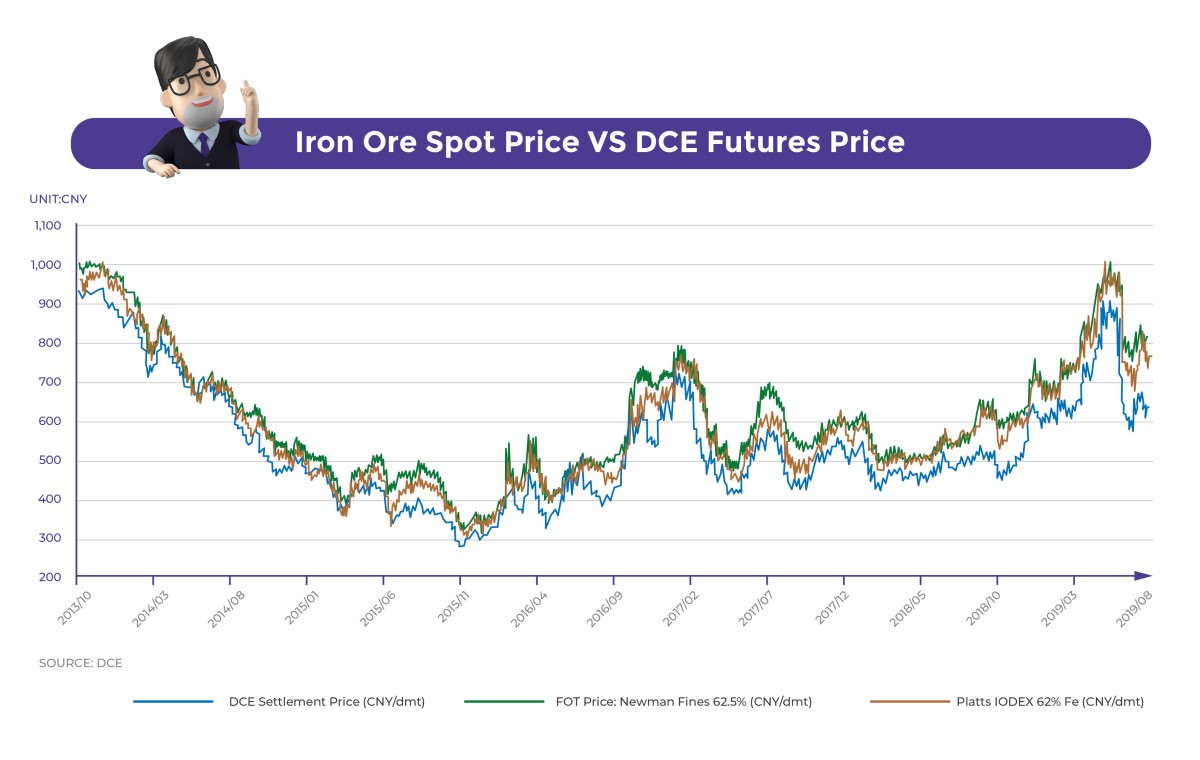

Box B: The Recent Increase in Iron Ore Prices and Implications for the Australian Economy | Statement on Monetary Policy – August 2019 | RBA

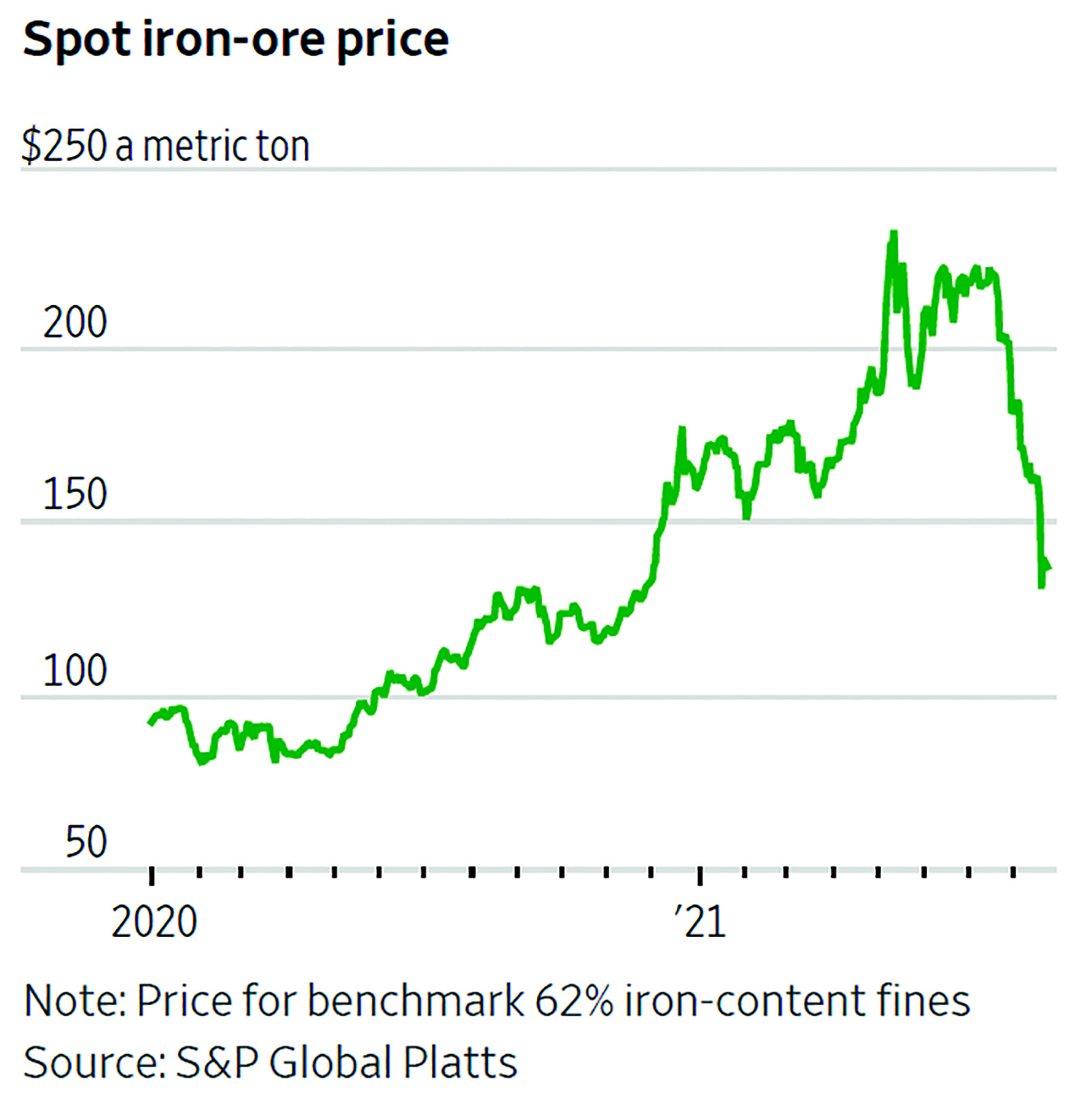

Trade Review: Signs of better downstream demand key to iron ore price recovery in Q1 | S&P Global Commodity Insights

Iron ore prices rebounded after Beijing released a rescue package to help the troubled property sector, but social unrest in China could erase the gains.

Iron ore/coking coal CFR China spot price relativity hits 10-year high at 99.6% | Hellenic Shipping News Worldwide

/fingfx.thomsonreuters.com/gfx/ce/jnvwyeawavw/China%20iron%20ore%20vs%20price%20Nov%2022.png_2.jpg)